Flexible Spending Account

Flex Spending Account Breakdown

How do I allocate my flexible spending credits? (new resident physicians)

Between July 1 and July 31 (11:59 p.m.), you will need to do the following:

- sign into your e-People account

- click on “Benefits Home” button

- click on “Benefits Enrollment” button (located near the bottom of the page)

- click on “Select” button to start the allocation process

- click on “Edit” button next to the “Flex Spending Health-Canada” line item

- on the “Flex Spending Health-Canada” page:

- If you don’t want to allocate to your health spending account: select “I don’t want to enroll”

- If you want to allocate credits select “Health Choice Spending” then click on the circle beside “Health Choice Spending”

- click in the “Annual Pledge” field and enter amount

- click “Continue” button to save your selections

- click “OK” button (once you have received a confirmation of allocations)

Repeat previous step for the Personal Spending FSA and Flex Spending RRSP

- make sure all your allocations total $1,000

- after you have allocated your $1,000 of credits click the “Submit” button

- review your submission. If everything is correct, click “Submit” again.

- click “OK”

- click “Sign Out” to end your session You must click submit twice in order for your submission to be successful. The morning after your submission, you will receive an automated email confirmation to your AHS email address.

You may change your submission as many times as you want, until the end of the allocation period. Your final allocation will be based on your last successful submission.

NOTE: If you do not allocate your credits by the deadline all your credits will be deposited into your Health Spending Account. Once the deadline has passed, changes to your allocation will not be permitted. Please note that Blue Cross benefits automatically default to ‘single’. If necessary, be sure to change this to ‘family’ or opt-out.

How do I set up my Flex Spending RRSP Plan?

The first step is to allocate your flex credits to the Flex Spending RRSP account on AHS e-People. Once you have allocated flex credits to the Flex Spending RRSP for the first time, you must set up an individual plan within the Group RRSP plan with Manulife within 60 days of the last eligible allocation day. If you fail to set up a plan within the 60 days, your allocation will default back to the Health Spending Account.

To Enroll Online

- Once Alberta Health Services has communicated to Manulife your demographic information, Manulife will mail your user ID and password to your home so that you can access the VIP Room.

- If you have not received your user ID and password within two weeks of making your allocation contact Manulife at 1 (800) 242-1704 ext. 4000.

- Once you have enrolled into the plan via the VIP Room, all you have to do is print the beneficiary designation form and either mail it to Manulife, fax it to them at 1 (888) 712-6010 or scan it and send it to them at retirement.solutions@standardlife.ca

- In the event you are having difficulty obtaining a user ID and password, please enroll using an enrollment form. See below for more details.

To Enroll Using an Enrollment Form

- Go online to the Manulife Website to access the enrollment forms. Remember that separate forms need to be completed for spousal contributions.

Remember that separate forms need to be completed for spousal contributions.

- Once the paper form is completed, send it to Manulife by either mail, fax (1-888-712-6010) or scan it to retirement.solutions@standardlife.ca

The enrollment forms are not mailed to the members.

If you have any questions concerning the forms or need guidance, you can call the Manulife contact center at 1 (800) 242-1704 ext. 4000

What can I claim through my Health Spending Account

Resident physicians are able to claim expenses above the Supplementary Health and Dental Plan maximums, expenses not covered by those plans, and premiums for those plans (the resident pays 25% of the Blue Cross premiums). The expenses can be incurred by the resident or any eligible dependent. To make a claim, fill out the Health Spending Account form and mail it to the address provided on the form.

Remember that you only have 60 days after the end of the academic year on June 30 (i.e. August 30) to submit claims for the preceding period. The easiest way to claim reimbursement for the Blue Cross premiums paid is to submit your last December pay stub and your last June pay-stub to the Blue Cross using the Health Spending Account form on PARA’s website.

What happens to unused flexible spending account credits on June 30th?

Any unused credits in your health spending account or your personal spending account carry forward for one year but can only be used on expenditures made in the current academic year. After that time, any unused credits are forfeited by the resident physician.

It is important to note any claims related to an academic year (July 1-June 30) must be made within 60 days of the year end (meaning August 30). If the claim for expenditures made is not into Blue Cross by this deadline, it will be rejected. If a resident physician is in the final year of residency, the flexible spending account terminates at the end of your contract.

However, you still have two months to get any claims to Blue Cross (for expenses incurred prior to the completion of your contract). Any unused credits remaining after the claim period are forfeited.

What is a flexible spending account?

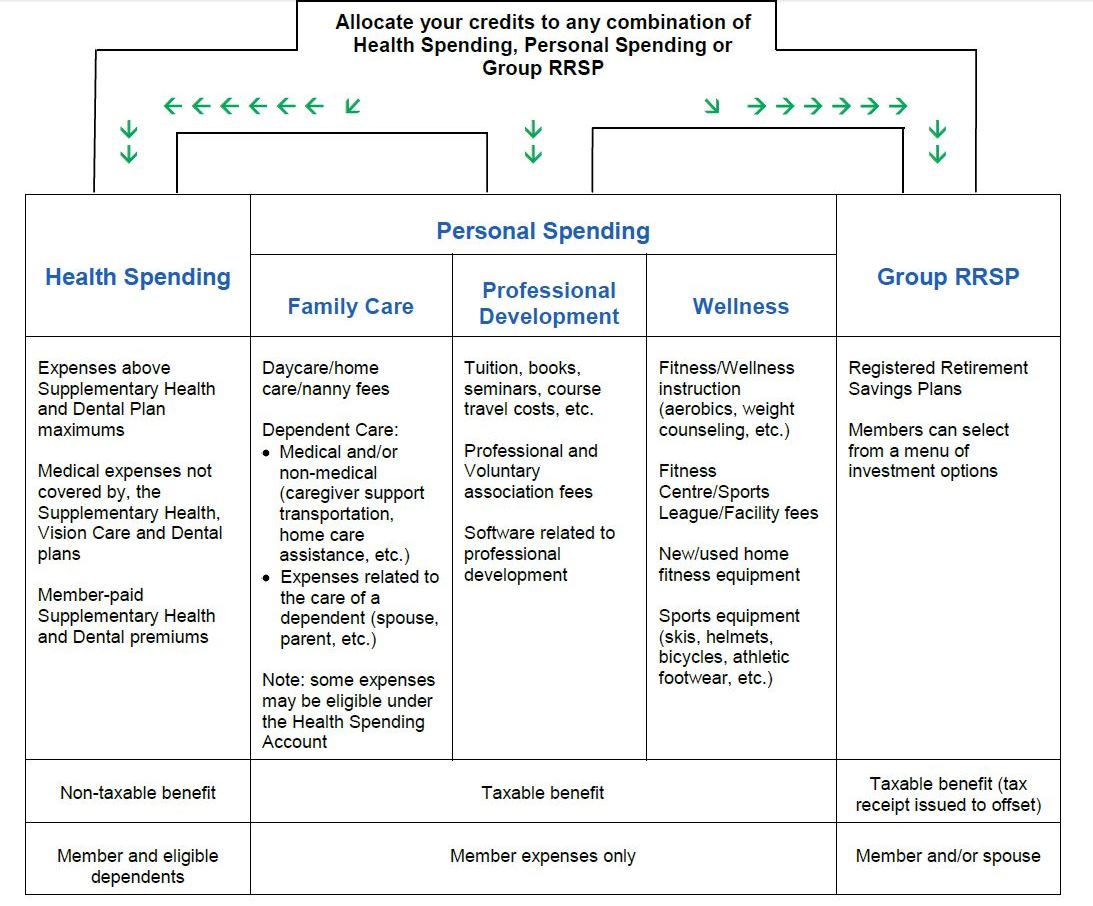

Each year a resident physician has 1,000 flex credits (1 flex credit = $1) that can be allocated between Health Spending, Personal Spending, and Group Savings. Resident physicians must allocate the flex credits to the various areas or 100% of credits will default to the Health Spending Account.

Health & Dental

Alberta Blue Cross Health & Dental Plan

Please log into your AHS e-people account to access your Plan #

***

Alberta Blue Cross mails the ID cards directly to the employee’s home address (the one submitted to e-People). Alberta Health Services will pay 75% of your monthly Blue Cross premiums. Blue Cross covers expenses for prescription drugs, private nurses or billable hospital expenses. Travel insurance is also included with your group benefits plan.

Note: It is advisable to check with the insurer prior to incurring an expense. For further information, contact AHS Benefits:

Phone: 1 (877) 511-4455

Email: HRContactCentre@albertahealthservices.ca

For information regarding making a claim, contact an Alberta Blue Cross agent:

Phone: 1 (800) 661-6995

Coverage

To determine what is covered under the supplementary health and dental plan check out the following documents:

Alberta Health Services pays 75% of the monthly premiums for the supplementary health and dental benefits.

Premiums

Liability Insurance

About

As a condition of residency, membership in the Canadian Medical Protective Association (CMPA) is required for all Resident Physicians. This means that each resident physician must apply for membership. Check out the CMPA website for information on how to apply.

As well, resident physicians are part of the Authority’s general liability insurance coverage when working at AHS facilities. This coverage does not extend to non-AHS facilities.

Life & Disability Insurance

About

The Alberta Medical Association, through its wholly-owned subsidiary, ADIUM Insurance Services Inc. (ADIUM), administers the PARA Group Disability and Life Insurance plans for PARA members.

Enrollment forms are included in the orientation package distributed to resident physicians when they start their residency program. Resident physicians need to complete the enrollment form in order to designate their life insurance beneficiary and provide program information and completion dates to ADIUM and the insurance company.

If you have an address change or need to make a beneficiary change, contact ADIUM:

Phone: (780) 482-0692

Toll-free: 1 (800) 272-9680 ext. 692

Email: adium@albertadoctors.org

About PARA Group Disability Insurance

- Benefit is 75% of your gross monthly resident salary (taxable)

- Benefits start after 90 days of disability

- Benefit period is to age 65, or until no longer disabled

- Coverage is convertible to the AMA Disability Insurance plan completion of residency.

Please contact ADIUM Insurance Services Inc. as soon as possible after the onset of your leave to report your possible long-term disability claim. This action will ensure a timely transition from Sick/Special leave to the commencement of benefits under the PARA Disability Insurance Plan.

About PARA Group Life Insurance

- Flat payout of $150,000 in the event of death.

- Benefit is payable to your designated beneficiary.

- Premiums are paid by PARA.

- Benefits payable are non-taxable.

- Coverage may be converted to the AMA Term Life Insurance Plan at the completion of residency, and is portable throughout the world.

Additional Life and Disability Insurance Coverage

The AMA offers members up to $5,000,000 of life insurance coverage, with proof of good health. Premiums start from as little as $9/year per $50,000 of coverage.

The AMA offers members up to $4,000/month of disability insurance to supplement your PARA disability coverage. Premiums start from as little as $6/month per $1,000 of monthly benefit, plus there is a 50% discount for resident members.

Both the AMA Term Life and Disability Insurance plans are portable throughout the world.

For further information, contact AMA’s ADIUM Insurance Services at adium@albertadoctors.org or call 1-888-492-3486.

Eligibility & Features

All PARA members who pay dues and are Ministry funded automatically receive long-term disability coverage while they are a resident physician, with their premiums paid by Alberta Health Services.

All PARA members who pay dues receive life insurance coverage with premiums paid by PARA. These benefits will end with the termination of your membership with PARA.

Features of these Plans

- No evidence of insurability is required.

- Coverage commences the first day of the month after you begin your duties.

- Coverage is in force 24 hours per day.

Maternity and Parental Leave

Am I eligible for Employment Insurance Maternity/Parental Benefits?

You must be a birth mother or father or adoptive parent and have accumulated 600 insured working hours within the last 52 weeks or since your last claim. For purposes of calculating insured working hours, AHS records resident physicians hours at 40 hours per week.

If you are in your first year of residency and have not yet accumulated 600 hours, you may still be eligible if you have insured working hours from another source/employer. You will need to check with Service Canada to see if you are eligible.

Are there any considerations that I need to take into account when applying for a waiver of training at the end of my A: training because of my time away for maternity leave?

Training because of my time away for maternity leave? Each university has their own waiver of training policy which can be found on its Postgraduate Medical Education website. When considering your waiver of training applications, keep in mind that the criteria for writing certification exams in Canada and the United States are different; if you are planning to write the American exam, you will need to ensure that, with your waiver of training, your length of training still meets the eligibility requirements for writing the exam.

Can I cancel my CMPA coverage during my maternity leave?

Yes. While you are on leave, you are not able to work as a resident physician (or an extender) because you are not actively in residency training. So, you should contact the CMPA to cancel your membership for the period of time that you are not working. Call 1 (800) 267-6522 between 8:30 a.m. and 4:30 p.m. EST or check out www.cmpa-acpm.ca.

Can I make claims from my flexible spending account during my maternity leave?

Yes, PARA members can access their flexible spending account while on maternity leave. This benefit is not contingent on a resident physician opting in to their health and dental coverage.

Do my health and dental benefits continue during my maternity leave?

No, cost sharing of your health and dental coverage does not continue during your maternity leave. A resident physician has the option of continuing the Supplementary Health and Dental benefits coverage by submitting the “Benefits Coverage During Leaves of Absence” form that is included in the Maternity Package you receive from AHS Benefits three months before your expected due date. This form must be submitted to Benefits prior to the start of your maternity leave. If you do opt into your health and dental benefits, you will be responsible for paying 100% of the health and dental benefit premiums.

Does my life and long-term disability coverage continue during my maternity leave?

Yes, PARA ensures that your life and long-term disability coverage continues while you are on maternity leave by covering the cost of your benefit in full. No additional paperwork is required from PARA members.

How can I obtain a Record of Employment from Alberta Health Services?

Ensure that your program has submitted a Leave of Absence form to the Postgraduate Medical Education office. The AHS Benefits Service Centre, upon receiving this information from PME, will process your LOA during your final week of earnings. A Record of Employment (ROE) will then be issued by the AHS Payroll department following the payment of your final earnings. Your ROE will be sent electronically to Service Canada. Once ROE is uploaded to Service Canada Web page, you should be able to log into your Service Canada account and download the copy for your records.

If you are on sick leave prior to the birth of your baby, please call the Benefits Service Centre to advise them of the date you delivered your baby and when your last day of paid sick time is. Your ROE will then be processed as described above.

If you do not have your ROE one week after the start of your maternity leave, you should contact:

University of Alberta

HR Contact Centre at 1-(877) 511-4455

University of Calgary

Medical Education Office at (403) 943-1253.

How much time can I take for maternity leave? (see Article 11.04)

Birth mothers may take up to 78 consecutive weeks of job-protected leave. However, it is important to realize that not all of this leave is considered maternity leave.

Maternity leave is for up to 17 weeks of the total leave time. It is this time that is eligible for the “top- up” payment to ensure that the resident physician receives 90% of her salary when combined with the EI benefits paid during this time.

After 17 weeks, the mother is eligible to take up to another 61 weeks of unpaid parental leave during the first 78 weeks following the birth of a child.

I’m returning to work - who do I talk to about requesting a space to breastfeed?

It is AHS’ responsibility to provide a private space for you to breastfeed; however, you will need to contact AHS prior to returning to work to request that they locate a space for you.

You will need to fill out a ‘Request for Accommodations’ form, which can be found on the AHS website. Once there, search for “Employee Request for Accommodation”, and it will be the first available option.

If I don’t receive a Maternity Package from Benefits three months before my expected due date, what should I do?

University of Alberta resident physicians should contact HR Contact Centre at 1 (877) 511-4455

University of Calgary resident physicians should contact Wendy Mitchell in the Medical Education Office at (587) 774-7467.

Make sure your program has informed PGME of your maternity leave.

Maternity and Parental Benefits (Employment Insurance)

Maternity benefits are up to 15 weeks. Maternity benefits are only available to the person who is away from work because they’re pregnant or have recently given birth. They cannot be shared between parents.

Birth mothers may receive the following benefits:

- Standard parental leave

- up to 35 weeks (in addition to maternity leave of 15 weeks) for a total of 50 weeks of benefits at 55% of salary to maximum of $595 weekly

- Extended parental leave

- up to 61 weeks (in addition to maternity leave of 15 weeks) for a total of 76 weeks of benefits at 33% of salary to maximum of $357 weekly

What happens if I can’t work prior to the onset of my maternity leave?

You may be eligible for paid Sick Leave prior to your maternity leave. In such cases, be prepared to provide a doctor’s note and advise your Program Director that you require paid sick time. Please ask your program to provide written notification to AHS Human Resources confirming the date on which your medical leave started.

What is the PARA maternity top-up benefit?

The PARA maternity top-up benefit tops up your employment insurance maternity benefits for 17 weeks (2 weeks at 90% of salary to represent the EI waiting period and 15 weeks at a rate that when added to your EI payments equals 90%). You are required to fill in a Supplementary (Un)Employment Benefit form in order to be eligible for this benefit. Keep in mind that income tax and CPP will be deducted from this amount.

This form should be included as part of the maternity package you receive from AHS.

What is the PARA Parental Leave benefit?

Where a resident physician has or adopts a child, but is not eligible for maternity leave, he/she is eligible for two weeks paid leave; In addition, a Resident Physician shall receive at her/his request additional leave without pay or benefits as follows:

- Maternity Leave granted – total leave of up to seventy-eight (78) weeks inclusive of any leave taken under Article 11.03(b), or

- No Maternity Leave granted – total leave of up to sixty-two (62) weeks inclusive of any leave taken under Article 11.04(a).

When can I begin my maternity leave?

You may begin maternity leave up to 8 weeks before your estimated due date once you give your employer the required written notice which indicates the date your leave will begin. The latest that you may begin your maternity leave is the date of the birth of your child. Resident physicians have the option of going on sick leave prior to the start of their maternity leave at the recommendation of their physician.

When can I choose to stop performing overnight call? (see Article 19.02)

Unless a PARA member chooses otherwise, she will not be required to perform a call in excess of twelve (12) hours or between 2400 and 0600 hours after 24 weeks gestation.

If there is a valid medical reason (typically a medical certificate from your doctor), the pregnant resident physician could stop overnight calls and/or shifts in excess of twelve hours earlier.

When should I let my program know?

Resident physicians are strongly encouraged to let their programs know as soon as they feel comfortable sharing family planning information. Your Program Director should not find out from others in the program.

Good communication will help to minimize training disruptions for you and service disruptions for your program. Additional notice also helps ensure that the necessary administrative work that allows for a smooth transition to maternity leave is in place within your program, the Postgraduate Medical Education office and AHS Benefits and Payroll.

When would I apply for my PARA maternity top-up benefit and when should I expect to receive this payment?

You can apply for your PARA maternity top-up benefit by completing the Supplementary (Un)Employment Benefit form (or PARA SUB-Plan application form) and obtaining your first EI maternity benefit confirmation; send both to the Benefits Service Centre (details are on the form). Provided that all the correct documentation is received in a timely manner, resident physicians will receive a lump sum cheque approximately 4.5 – 5 months after the start of their maternity leave.

IMPORTANT: The SUB Plan Application form must be submitted within six months of a resident physician going on maternity leave. If this deadline is not met, the top-up payment will not be processed by AHS.

Note – if the lump sum payment will create significant financial hardship for you, please contact PARA to see if PARA is able to assist in requesting top-up in two payments for you.